The coverage of the negative consequences of the Corona pandemic and the governmental support measures are still omnipresent. It is easy to lose sight of the fact that there are also winners from the pandemic, first and foremost, of course, the German flagship company BioNTech. In addition to the pharmaceutical industry and medical technology, food retailers, online retailers, delivery services and software companies, among others, have also benefited. The construction industry can also continue its growth path almost uninterrupted. As sales and earnings have risen, so too have the demands on the quality and quantity of the internal accounting service provider. Particularly when operational business is growing rapidly and placing intensive demands on everyone, accounting structures and processes can literally fall by the wayside.

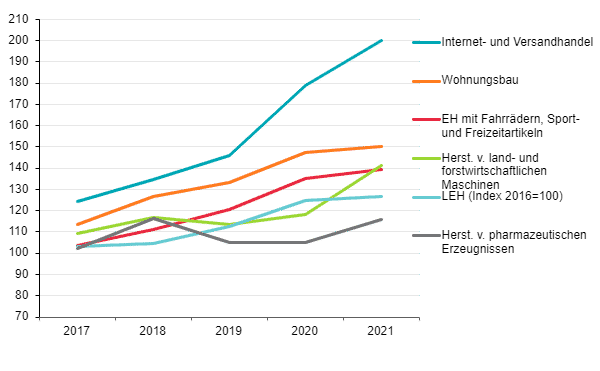

Sales development of selected growth industries

Is the internal service provider accounting in danger of falling by the wayside? Symptoms may include:

- Annual financial statements are not completed on time

- Tax consultants and auditors are on hold due to postponed deadlines

- Dissatisfied, overworked accounting staff resulting in high staff turnover

- Processes and software no longer meet the increased requirements

This was also the case for a successful project developer for commercial real estate with more than 40 individual companies, which asked HANSE Consulting for support in optimizing its accounting system.

Step 1: Recording the current situation

In short interviews with the employees and the management of the accounting department, we recorded the current processes and structures of the accounting department, including the interfaces to other departments.

- Most of the employees had been on board for less than a year due to a high turnover and some were still in the induction phase.

- The number of companies and the volume of accounting material had more than doubled in the last 10 years. The number of employees has remained the same for 10 years.

- The accounting department has numerous interfaces with other operational organizational units with a high need for coordination (e.g. planning, construction, property management).

- The IT structure has been thoroughly renewed in the last two years:

- New planning tool for integrated corporate planning.

- New software for property and construction site management including document management and workflow system.

- New ERP system.

- During the software introduction, the focus was on the operational requirements of the departments; interfaces and integration of the accounting system seemed less pressing. As a result, proper use – e.g., for the monthly advance sales tax return – was made more difficult.

- The tasks involved in preparing the annual financial statements were particularly extensive because no interim financial statements had previously been prepared for example, accruals and deferrals and preparatory work required for this could not be performed by the accounting department within the framework of the established processes.

Step 2: Analysis of weak points

he main weaknesses quickly emerged from the interviews.

- High proportion of new employees and insufficient capacity in comparison to companies with similar tasks and size, excessive demands on time and in some cases on expertise, no clear assignment of responsibilities to tasks, comparatively many accounting errors.

- Mountain of old tasks: The predominantly new employees are faced with a perceived “insurmountable” mountain of piled-up tasks, according to their own statements.

- New software: Difficulties in daily handling in financial accounting and at the interfaces to other areas, many variables, individual setting options increase the degrees of freedom, but also the supposed implausibility.

Step 3: Development and implementation of pragmatic solutions

In two workshops and in close coordination with the division management, we developed pragmatic solutions that could be implemented. We provided support during their implementation.

- Optimization of the organizational structure, combined with the filling of two additional positions for the topics of taxes and group accounting. As a result, the tasks of the balance sheet and financial accountants were streamlined to include technically demanding special topics, thus freeing up capacity among existing employees.

- Teams were formed, each consisting of one financial accountant and one balance sheet accountant, and responsibilities were assigned for specific companies. This made it possible for accounting staff to identify with the project companies they are responsible for. They are now aware of operational issues and can book them appropriately. In addition, there are fixed contact persons in the operating departments, which facilitates communication at the interfaces and enables matters to be clarified more quickly.

- Establishment of the preparation of quarterly financial statements to ensure that preliminary work on the annual financial statements is carried out during the year.

- Prioritization of the most important project companies. This took the mental burden of the “insurmountable” mountain off the employees.

- Joint development of standard workflows with processes, deadlines and responsibilities with employees from accounting and other departments in workshops and work meetings. The clarification of the interfaces between accounting and the other departments.

- Implementation of the workflows through training of all involved employees and pragmatic success control.

- Employees record open issues in their daily work with the new software in a permanently accessible issue repository as soon as they arise. These are prioritized with the accounting management and successively worked through in newly introduced regular jour fixe meetings with the external software service provider according to priority.

In addition to the optimization of quality and response time in accounting, the Executive Board was delighted with the greater economic transparency gained through the interim financial statements.

Conclusion

When companies grow rapidly, the processes and structures of internal service departments often lag. A spiral of overload sets in, which prevents a release from the hamster wheel from succeeding on its own. In such unfortunate situations, HANSE Consulting is at your side as an external supporter.

Our consultants are hands-on experts who have gained several years of experience in industrial companies themselves. Coupled with technical and industry expertise and our approach to specifically analyze the weak points and find suitable, pragmatic solutions, HANSE Consulting can support you efficiently.

Contact us with your questions about your accounting system before it falls by the wayside.

Feel free to make a non-binding appointment with one of our experts.

Dr. Armin Bratz – Christina Sonnemann – Heiner Winters

Project Story: Organize, Modernize And Digitalize Controlling Processes

HANSE Consulting creates efficient controlling processes and frees up resources The initial situation The esteemed…

Increased interest rate level threatens earnings opportunities of property developers

Sensitivity analysis quantifies risks Increased interest rates threaten earnings opportunities in the real estate industry,…

What is the biggest benefit at HANSE Consulting?

HANSE interview with Maximilian Staack and Maurice Beyenbach Flexible working, work-life balance & Co. are…

![[EN ]Hanse Consulting](https://en.hanseconsulting.de/wp-content/uploads/sites/21/2022/06/hc22_logo_350.png)