The Russian war of aggression on Ukraine is currently hitting the world’s energy markets. Faster and stronger than expected before the war, current prices for oil and gas have risen and there is great uncertainty about the further development of energy costs. For business leaders and management, this can be a major challenge, and not just operationally. The development can also lead to uncertainty among stakeholders such as shareholders and financiers. The possible effects on business development and prospects, specifically also on the development of costs and earnings, must also be analyzed and communicated transparently to them.

Crude oil price development of UK Brent until 2022

While market changes such as the opportunities arising from rising energy prices tend to have medium- and long-term effects for wind power manufacturers, for example, they can present many companies with considerable – in some cases existential – challenges in the short term.

Time to examine the impact of energy price developments and shocks on one’s own business.

Simply looking at your own energy consumption volumes and multiplying them by the price changes of electricity, gas, oil and fuels is not enough to analyze and evaluate the dynamic energy price elasticity (the dependency of all income statement and balance sheet items on energy prices over time) of your own business.

At this point, it is worth looking at the income statement using the example of a company in the foundry and steel construction sectors

With a total operating performance of approx. EUR 39 million and earnings before taxes of approx. EUR 0.9 million (2.5%), gas and electricity costs together accounted for approx. and EUR 1.0 million, i.e. around 2.6% of total operating performance.

An increase in prices of approx. 68% corresponding to the increase in the price of oil from 1.12.21 to 21.3.22 would increase energy costs accordingly by approx. 0.7 million EUR.

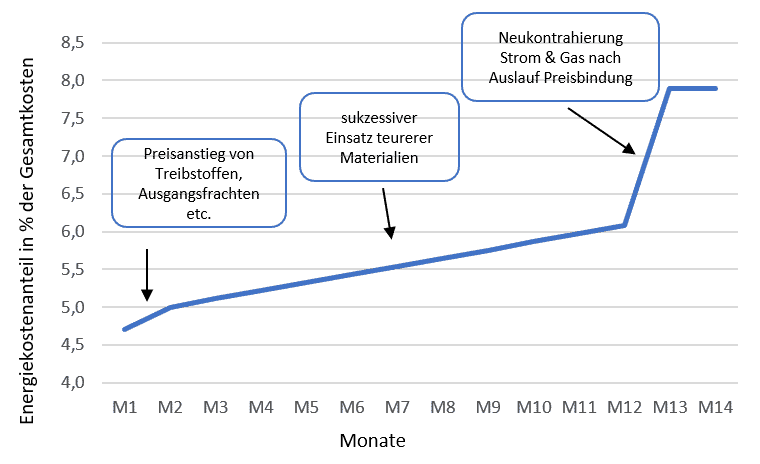

The raw material intensive company consumed about 6,600 tons of steel p.a.. With around 18 GJ of gas consumption per ton of crude steel produced and industrial costs of around EUR 2.50 / GJ, the company had spent an imputed EUR 296 thousand on the energy in the purchased steel. The current increase in energy costs, which has not yet been factored in, results in additional costs of EUR 200 thousand via the energy in the steel. Overall, after taking into account other energy-intensive costs (non-ferrous metals, fuels, initial freight) and the company’s energy source mix for 2021, it was found that approx. 4.7% of the costs were direct or indirect energy costs.

Based on the 2021 energy price level, this gave the company an energy price elasticity of 0.05% of total costs per percentage point change in energy costs. A cost increase of 70% of the energy mix on average would lead to an imputed increase in costs of 3.2% of total output (approx. EUR 1.3 million) and thus to a loss.

A reduction in energy costs would lead to a corresponding improvement in earnings.

The analogous analysis of the relevant balance sheet items showed an energy price elasticity of approx. 0.08% for the company’s working capital. The increase in energy prices by 70% would successively lead here to additional capital requirements for financing working capital of approx. EUR 0.7 million, which in this case would amount to approx. 2.7% of the balance sheet total.

At this point, the question naturally arises as to what the actual impact of this imputed risk will be and what action strategies can be used to manage it.

The first decisive factor here is how quickly energy cost increases have to be realized and whether they can be passed on to customers via price increases. Since in the case described the company had already contracted the energy prices for gas and electricity until the end of 2022, there is no short-term risk here. Similarly, the raw materials (steel, nonferrous metals) for existing orders were already almost fully contracted. The company was able to bear the remaining risk from increased freight rates and fuel prices for the fulfillment of existing orders. The temporal scope of the company’s purchase and sales contracts therefore resulted in a significantly lower risk position than would have been suggested by looking at energy price elasticity alone.

In order to assess the earnings and liquidity risk resulting from the volatility of energy prices and to install appropriate risk management, one must therefore first analyze the energy price elasticity and the risk position resulting from the existing contracts. Depending on the specific business model and the level of risk, this can be a very different approach in the short term and in the long term.

One option would be to avoid risk by reducing direct and indirect energy costs. In the even longer term, energy purchases could be reduced through in-house generation.

Alternatively, and in the shorter term, ensuring the risk through energy derivatives could be an option.

Example price elasticity of the energy cost share over time

While the current market environment does not offer a perfect instant solution. However, by developing a detailed numerical basis for the effect of energy price changes, transparency can be created about possible effects, based on which strategies can then be developed.

Another, completely different example to conclude

A HANSE Consulting client was producing in halls that were rented at a low price but were very costly in terms of energy. In 2019, the landlord demanded an inflation-based index cold rent for the extension of the lease, which was urgently needed by the client. An alternative proposal was developed with HC: Consumer price-based index rent, yes, but an offsetting component of declining rent based on energy price trends. This comes into play when energy prices rise more than the general cost of living. The landlord agreed to this during the fair negotiations – with a currently serious impact on the rent, which acts as insurance for the company – with a certain degree of causation.

The playing field for strategic solutions is wide!

Contact us with your questions about your energy price risk.

Please feel free to make a non-binding appointment with one of our experts.

Dr. Armin Bratz – Thomas Barth – Dr. Thomas Zubke – von Thünen

Project Story: Organize, Modernize And Digitalize Controlling Processes

HANSE Consulting creates efficient controlling processes and frees up resources The initial situation The esteemed…

Increased interest rate level threatens earnings opportunities of property developers

Sensitivity analysis quantifies risks Increased interest rates threaten earnings opportunities in the real estate industry,…

What is the biggest benefit at HANSE Consulting?

HANSE interview with Maximilian Staack and Maurice Beyenbach Flexible working, work-life balance & Co. are…

![[EN ]Hanse Consulting](https://en.hanseconsulting.de/wp-content/uploads/sites/21/2022/06/hc22_logo_350.png)