Internationally operating companies usually have foreign subsidiaries and investments for sales, manufacturing and service. The independent local management of the companies is necessary for the success of the companies in the markets. However, the international units harbor high earnings and liquidity risks if they are not closely managed and in addition integrated into group controlling.

The initial situation before the integration into Group Controlling

Our client, a globally active group of companies in the special machinery sector, experienced surprisingly high losses in its international subsidiaries. In conjunction with stagnating incoming orders, the German parent company was facing an earnings and liquidity crisis.

HANSE Consulting was commissioned to develop a restructuring concept. Due to the already known causes of the crisis, the improvement of the controlling of subsidiaries and investments was consequently a core issue.

Approaches for improvement were identified in the management of the shareholdings

- Management at the subsidiaries and joint ventures was not required to prepare regular monthly financial statements. In addition, information on economic developments during the year was only requested on an as-needed basis.

- Accounting at the foreign subsidiaries was performed by the company’s own employees or outsourced to external service companies.

- In view of the stable earnings situation, it was not considered necessary to carry out systematic controlling of the subsidiaries.

- Annual financial statements were not consistently audited by auditing companies for all shareholdings.

- As the Group had sufficient liquidity, it was not considered necessary to manage (net) working capital.

- No forecasts or comparisons of budgeted and actual figures were prepared for the portfolio companies.

The late knowledge of the negative development of the investments caused an earnings and liquidity crisis for the entire Group

- The local management kept quiet about negative economic development because there was no “uncomfortable demand” from the parent company.

- Due to the late knowledge about the actual economic development of the investments, their high losses could only be detected.

- As a result of the late recognition of the losses and worthless assets, a high short-term financing requirement was only recognized with a delay.

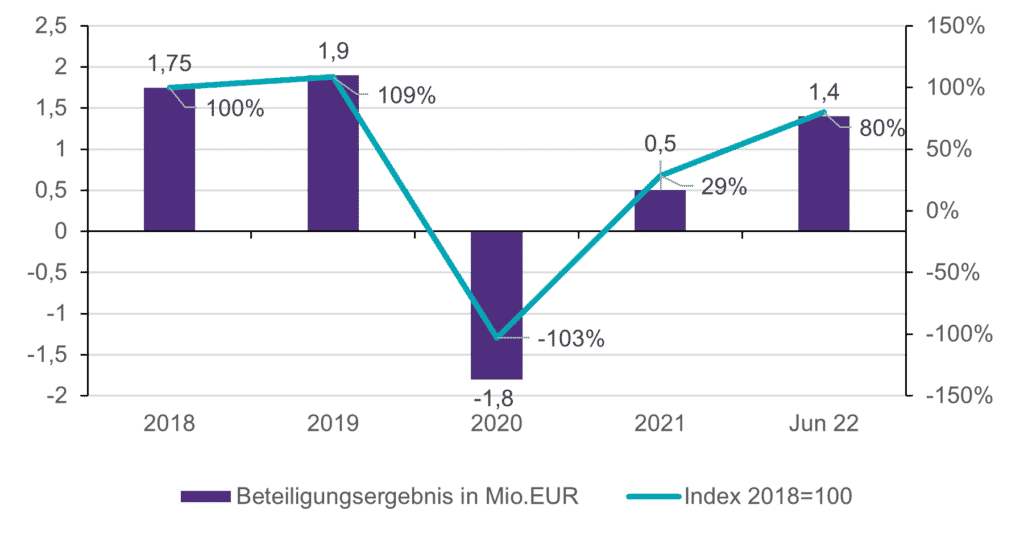

Development of income from investments 2018 to June 2022

- Some of the financial statements not audited by independent auditors turned out to be incorrect:

- Changes in inventories (in several previous years) of raw materials and supplies and work in progress that had not been fully posted had led to the supposedly good margins and results. Accordingly, the inventories that did not exist had to be subsequently derecognized.

- High receivables inventories contained many receivables that had been due for a long time and which, upon examination, turned out to be worthless.

- On top of this, the loss of confidence of the financing partners in the management of the parent company, who were only informed about the undesirable developments at a late stage.

The investment controlling department was restructured in terms of content and personnel

Together with the client’s new management, the HANSE Consulting team reorganized and restructured the commercial area and the investment controlling. HANSE Consulting also took over the tasks of investment controlling on an interim basis until new employees were hired.

Introduction of a regular reporting system

- Establishment of a regular monthly internal reporting system with clear competencies, responsibilities and timeframes

- Definition of uniform reporting packages for all group subsidiaries and investments.

Replacement of personnel

HANSE Consulting created the job profile, the qualification requirements for the candidates and supported the management in the professional candidate selection.

The management concept in the form of “management by objectives” / “management by facts and figures” was also introduced at the shareholdings

- Installation of a new “control structure” with analysis of deviations and clarification of causes based on monthly planned/actual comparisons of the income statement, balance sheet and cash flow statement.

- Furthermore, the definition of business management target ratios for the management of the shareholdings. As a side effect, the degree of achievement of key performance indicators can also be used as the assessment benchmark for variable management compensation components.

- Planned/actual comparisons and working capital development are discussed in regular meetings between investment controlling and local management.

The result of the change process from integration into Group controlling to turnaround

Transparency, control and management of shareholdings were significantly improved with measures that were relatively quick and easy to implement. Undesirable developments are now identified at an early stage, enabling countermeasures to be initiated. The amount of capital tied up in working capital has also been reduced. Earnings and liquidity risks have now been reduced and the Group has achieved a turnaround.

Contact us if you would also like to have more transparency about your investments and improve the controlling of your investments.

Please feel free to make a non-binding appointment with one of our experts.

Dr. Armin Bratz • Arne Brandenstein

Project Story: Organize, Modernize And Digitalize Controlling Processes

HANSE Consulting creates efficient controlling processes and frees up resources The initial situation The esteemed…

Increased interest rate level threatens earnings opportunities of property developers

Sensitivity analysis quantifies risks Increased interest rates threaten earnings opportunities in the real estate industry,…

What is the biggest benefit at HANSE Consulting?

HANSE interview with Maximilian Staack and Maurice Beyenbach Flexible working, work-life balance & Co. are…

![[EN ]Hanse Consulting](https://en.hanseconsulting.de/wp-content/uploads/sites/21/2022/06/hc22_logo_350.png)