Also due to the professional liquidity management in the insolvency and the close cooperation with the insolvency administrator, the trading company was successfully sold to a new owner after almost five months of business continuation. With professional liquidity planning during the insolvency proceedings, a significant improvement for the creditors and a continuation of the company was achieved.

The initial situation

Due to a failed refinancing, our client, a German trading company importing its products mainly from the Far East, had to file for preliminary insolvency proceedings at the end of 2021. Due to long delivery and transport times as well as unpredictable call-offs, especially from major customers, the company has to pre-finance a large part of the goods over several months.

The preliminary insolvency administrator commissioned HMC Hanse Management Consulting GmbH with the preparation and ongoing updating of a weekly liquidity planning to closely accompany and control the continuation of operations.

Special requirements for liquidity planning

Liquidity planning can be created quickly if the data is up-to-date and consistent. The software tool used is filled with the relevant data and the result is liquidity planning. Once the data sources have been coordinated and the tool has been set up for the specific case, the planning can be updated weekly with little effort.

In the context of insolvency, other important aspects have to be taken into account when planning cash inflows and outflows, e.g. rights to segregation and separation and frequently changed delivery and payment terms. Due to the insolvency, container shipments were postponed almost daily by the suppliers in our mandate or container freight was changed to prepayment, resulting in a highly volatile data and liquidity situation.

In the context of insolvency, other important aspects have to be taken into account when planning cash inflows and outflows, e.g. rights to segregation and separation and frequently changed delivery and payment terms. Due to the insolvency, container shipments were postponed almost daily by the suppliers in our mandate or container freight was changed to prepayment, resulting in a highly volatile data and liquidity situation.

The preparation of the planning in this mandate was further complicated by the fact that the relevant data available from financial accounting and the ERP system were unreliable and incomplete. A major weakness here was that not all the information and data to be considered in liquidity planning was managed in financial accounting and the ERP system or was up-to-date and consistent. Customer and supplier orders, freight invoices, order documents, shipping information and other important information on the operating business were managed decentrally in Excel lists, exchanged by e-mail or communicated by telephone. Prepayments made had been unclearly accounted for. Receivables had not been reduced by credit notes, and payables had not been accurately cleared with payments already made. For the many containers, there was no clear allocation of content to the customer orders on hand.

A complete and consistent database for liquidity planning had to be developed step by step and continuously updated.

The solution approach

In this dynamic environment, the Company’s liquidity had to be managed very closely, as even postponements of a few containers meant corresponding shifts in sales and thus liquidity in significant amounts.

HANSE Consulting therefore planned the company’s liquidity at container and customer level. For this purpose, the first step was to qualify the data in the heterogeneous sources. The requirements for data quality and reliability were coordinated with the employees responsible for the operational business and the (preliminary) insolvency administrator. Was the customer order in written form or was there only a verbal or e-mail order? Had the shipping date of the container been confirmed by the shipping company commissioned? Criteria were worked out for the different circumstances as to whether and how they had to be included in the planning. Finally, the process of providing information was defined. The data, which came from a wide variety of sources, was then incorporated into the planning tool after a systematic check. For later traceability, the origin of the information was consistently documented for all items. A permanent exchange with the (preliminary) insolvency administrator, the sales and purchasing managers, and the company’s accounting department served to ensure that no insufficiency of assets occurred during the (preliminary) proceedings, but that the company could make payments from the proceedings account in order to maintain operations for the parallel M&A process.

Sales process and result

During the continuation of operations, the (preliminary) insolvency administrator held talks with several potential investors, two of which ultimately resulted in detailed offers.

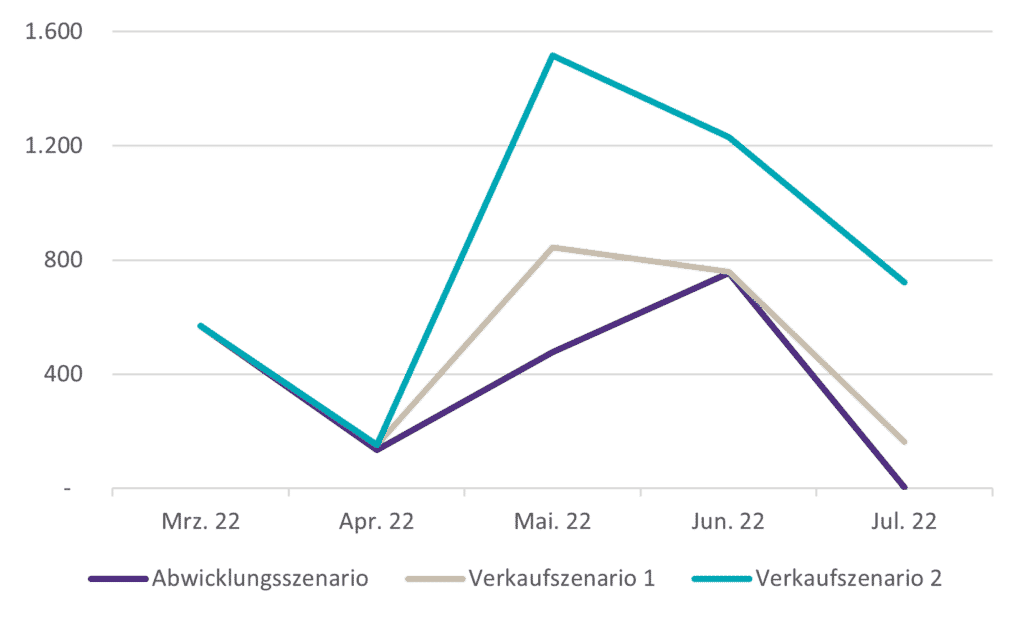

In order to be able to evaluate these in the interests of the creditors, scenarios had to be mapped in the liquidity planning to compare the assets as of the end of July 2022 (the target date for the termination of the proceedings). On the one hand, the offers, which differed significantly regarding the continuation at the existing location and the takeover of the employees, had to be compared. On the other hand, it had to be determined whether the liquidation of the company could even be the most advantageous option for the creditors.

Since the sales negotiations lasted several weeks, the scenarios had to be updated several times and revised to reflect the details of the repeatedly adjusted purchase offers.

Presentation of the expected liquidity development in EUR thousand as of the end of the month

Thanks in part to close liquidity planning and the management of the company based on this, the company was successfully sold and transferred to the new owner after just under five months of continued operations.

Conclusion

Liquidity planning in the context of insolvency proceedings is characterized by special challenges. In addition to frequent deficiencies in terms of data up-to-dateness and consistency, learning of the company’s insolvency can lead to significant and abrupt changes in customers’ and suppliers’ acceptance and payment behavior as well as payment terms (e.g. changeover to advance payment).

Knowledge of the insolvency law framework and close cooperation with the insolvency administrator and key employees are crucial for successful liquidity planning in provisional and opened insolvency proceedings. It can therefore be crucial for the success of the proceedings and the desired transferred reorganization to have the proceedings accompanied by an experienced advisor who is also familiar with the special challenges in the context of (preliminary) insolvency proceedings.

This is because the liquidity planning served as an essential basis for decision-making for all stakeholders, from the insolvency administrator to the buyers and sellers to the prospective buyers.

Contact us with your questions regarding your liquidity planning.

Please feel free to make a non-binding appointment with one of our experts.

Dr. Thomas Zubke- von Thünen – Klaas Albrecht

Project Story: Organize, Modernize And Digitalize Controlling Processes

HANSE Consulting creates efficient controlling processes and frees up resources The initial situation The esteemed…

Increased interest rate level threatens earnings opportunities of property developers

Sensitivity analysis quantifies risks Increased interest rates threaten earnings opportunities in the real estate industry,…

What is the biggest benefit at HANSE Consulting?

HANSE interview with Maximilian Staack and Maurice Beyenbach Flexible working, work-life balance & Co. are…

![[EN ]Hanse Consulting](https://en.hanseconsulting.de/wp-content/uploads/sites/21/2022/06/hc22_logo_350.png)